Boost Your Sales with Our Smart Chatbot

Automate responses and engage customers instantly.

Start your 7-day free trial today!

- Quick Response

- Boost Conversion Rates

- Automate Sales Process

Best AI ChatBot for

Banking

Real Estate

FinTech

Accounting

Artificial Intelligence in Banking

Artificial Intelligence is actively transforming the banking industry, increasing operational efficiency, improving customer interactions, and reducing operational risks. The introduction of AI into banking processes makes it possible to automate routine tasks, personalize financial offers, and ensure a higher level of transaction security.

Customer Service Automation

One of the key areas of application for artificial intelligence is the automation of customer service. Banking organizations receive a large number of inquiries related to payment processing, account status, credit terms, and other financial services. Artificial intelligence can significantly speed up the processing of such requests, provide customers with instant answers, and offer personalized recommendations. AI-powered virtual assistants and chatbots can resolve most common questions without operator intervention, reducing contact center workload and increasing customer satisfaction.

Transaction Security and Fraud Prevention

Another important aspect is ensuring the security of financial transactions. Artificial intelligence analyses transactions in real time to detect suspicious activity and prevent fraud. Using machine learning algorithms, banks can detect anomalous transactions and automatically block suspicious transfers. In addition, AI-based systems can analyse customer behaviour and detect attempts to gain unauthorized access to bank accounts.

Personalized Financial Services

Personalization of financial services plays an essential role. Artificial intelligence analyses customer preferences, financial habits, and transaction history to offer the most appropriate banking products. This allows banks to create personalized offers for loans, investment programs, and insurance, which increases customer loyalty and boosts profits.

Optimizing Internal Banking Processes

AI is also making banks’ internal processes more efficient. Automating document management, credit scoring, and risk assessment reduces the likelihood of errors and speeds decision-making. For example, AI systems can instantly analyse a borrower’s credit history and assess their solvency based on multiple factors, reducing the time it takes to process an application and minimizing the risk of issuing unwarranted loans.

Key Benefits of AI Chatbots in Banking:

- 24/7 Customer Support: AI chatbots provide round-the-clock assistance, addressing customer queries about account balances, transactions, loans, and more, without human intervention.

- Personalized Financial Advice: By analyzing customer behavior and financial data, AI chatbots can offer tailored financial advice, recommend products like loans, credit cards, and insurance based on individual needs.

- Efficient Transaction Assistance: AI chatbots can help customers make payments, transfer funds, track transactions, and even manage budgets in a simple, automated manner, enhancing overall banking experience.

- Improved Security and Fraud Detection: AI chatbots can detect suspicious activities and alert customers about potentially fraudulent transactions in real time, increasing security and preventing financial losses.

Challenges of AI Chatbots in Banking:

- Data Privacy and Security: AI chatbots must ensure the confidentiality of sensitive financial information, adhering to strict privacy laws and safeguarding customer data from cyber threats.

- Integration with Legacy Systems: Integrating AI chatbots into existing banking systems can be complex, especially for banks with outdated infrastructure, requiring significant investment in modernization.

- Understanding Complex Customer Queries: While AI chatbots are powerful, they may struggle with understanding highly specific or complex customer inquiries, which could lead to frustration or reliance on human agents.

Essential Tools to Develop a Successful ChatBot

AI-Powered Automation

Streamline client interactions by automating responses and appointment scheduling.

Seamless Data Integration

Connect with EHR and CRM systems to manage client information efficiently.

Lead Qualification

Identify and prioritise potential clients based on their inquiries and needs.

AI in Investment and Market Prediction

Banks are also actively using AI to predict market trends and manage investments. Analytical models based on machine learning make it possible to assess stock market dynamics, analyse macroeconomic factors, and develop asset management strategies. This enables bank customers to make more informed investment decisions and minimize risk.

Regulatory Compliance and Ethical Considerations

Despite all the benefits, the use of artificial intelligence in banking requires compliance with strict regulatory requirements. The implementation of AI solutions must comply with international data security standards, such as GDPR and PSD2, and take into account the ethical aspects of automated decision-making. The transparency of algorithms and the protection of customers’ personal data remain key challenges for banks using AI technologies.

The Role of AI in the Future of Banking

The application of AI in banking opens up a wide range of opportunities to improve the efficiency and security of financial operations. With automated processes, personalized service, and improved risk management, artificial intelligence is becoming an integral part of the modern banking system. Banks that invest in AI technologies can gain a competitive advantage and offer their customers more convenient, secure, and innovative financial services.

Advantages and functionalities of Crowdy ChatBot

Customisable Customer Interaction

Advanced AI-Powered Responses

Seamless CRM Integration

24/7 Availability

Data-Driven Insights & Analytics

How Crowdy Chatbot Enhances Financial Services

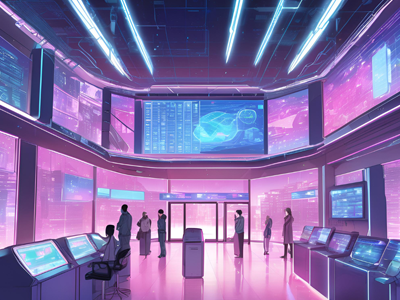

AI-Powered Automation in Financial Institutions

Artificial intelligence is playing a key role in transforming the financial sector, helping to automate processes, reduce operational costs, and improve customer service. The Crowdy chatbot, based on advanced data processing and machine learning technologies, can become an indispensable tool for banks, investment companies, insurance organizations, and other financial institutions.

Improving Customer Service Efficiency

One of the most in-demand functions of chatbots is customer service automation. Financial companies receive thousands of inquiries every day regarding account balances, transaction history, credit terms, insurance payments, and investment products. The Crowdy chatbot is able to respond to these queries instantly, providing users with accurate information and reducing wait times. This reduces the burden on contact center operators and allows customers to get the information they need quickly, without having to call or visit the office.

Seamless Payment Processing

Payment processing also plays an important role. Crowdy can help customers make transfers, pay bills, set transaction limits, and track payment status. By integrating chatbots with banking systems, they can automatically notify users of upcoming payments, remind them of debts, and offer personalized financial solutions.

Personalized Financial Recommendations

One of the key benefits of AI chatbots in the financial sector is the personalization of offers. By analysing customer behaviour, financial habits, and transaction history, Crowdy can recommend banking products, investment strategies, or insurance programs that meet individual user needs. This improves customer retention and increases the conversion rate of financial services sales.

Enhancing Security with AI Chatbots

From a security perspective, the Crowdy chatbot also offers significant opportunities. It can perform initial customer verification using multi-factor authentication, recognize suspicious requests, and alert users to potential risks. For example, if a customer encounters fraudulent activity, the chatbot can immediately direct them to security, offer card blocking recommendations, and analyse suspicious transactions.

Automating Financial Advisory Services

Automating financial advice is another important function a chatbot can perform. Crowdy can educate customers about personal financial management, explain the terms of loans, insurance, and investments, and help them apply for financial products. This reduces the burden on advisors and increases access to financial services.

Multilingual Support for Global Banking

Financial firms operating in international markets can take advantage of Crowdy’s multilingual support. The bot is capable of interacting in more than 30 languages, making it an ideal tool for banks and investment firms with a global customer base. Customers can receive advice in their native language, increasing trust and improving the user experience.

Data Collection and Analysis

Another important area of application for Crowdy is the processing and analysis of customer data. A chatbot can collect information about user preferences, conduct surveys, analyse feedback, and send the data to analytics systems. This helps financial companies better understand customer needs and optimize their services.

The Strategic Importance of AI Chatbots

Using Crowdy chatbots in the financial sector significantly improves customer service, reduces operational costs, and increases control over transaction security. With automated processes, personalized interactions, and multilingual support capabilities, companies gain a competitive advantage by improving financial services and increasing customer trust. Integrating an AI assistant into banking and investment systems is becoming more than just a convenient feature, but a strategic solution for successful business in the digital age.

Compatible Platforms

EE

Artificial Intelligence in Banking

At Crowdy.ai, we’re not just building innovative chatbot solutions — we’re building a community around smart customer engagement, automation, and the future of AI in business. As a forward-thinking company, we believe that transparency, education, and constant communication with our clients are essential to long-term success. That’s why we maintain an active online presence across platforms like YouTube, Instagram, LinkedIn, and other social media channels. Our goal is to keep you informed, inspired, and equipped to take full advantage of the latest advancements in artificial intelligence. By subscribing to our channels, you gain access to a stream of relevant, easy-to-understand content that can help you make smarter decisions, improve customer communication.